A few months back I talked about one of the bad sides of penny stocks as it relates to pump and dump hard mailers. If you’ve never received one in the mail consider yourself lucky. HERE is an example of one. A hard mailer is a glossy 10-30 page report that you would receive in the mail touting a penny stock. The report production and distribution is normally paid for by large or influential shareholders of the company. The goal is to increase the stock price and liquidity so they can sell their positions or for the company to do an equity funding at higher prices.

In most cases the disclaimer which discloses the amounts paid are hidden somewhere in the report like THIS. These hard mailer reports paint the rosiest of pictures touting the underlying penny stock as the next Google or Exxon. Of course none of the information is usually true or accurate, but you send enough of these reports to unsuspecting retail investors via mail, and the law of averages tells you a certain percentage will fall for it.

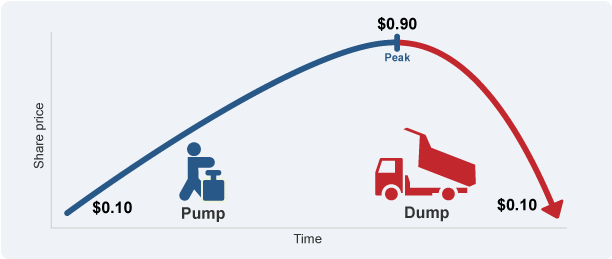

The positive effect of a hard mailer campaign can last a couple days to several weeks and the touted stock can see an incredible rise in a short period of time. Eventually though the amount of dumb money buying finally becomes extinguished and the stock falls. In some cases the company itself doesn’t even know about the hard mailer campaign (which is kinda funny when you think about it), but I believe in most cases they are well aware.

The tactic itself has been going on since the stock market began, and I’m more then sure it will continue. I used to immediately throw them in the trash or use them as kindling, but I’ve started to file them away recently just to track the long-term performance of the underlying companies. Here is the list:

The MicroCapClub (mc2) is an exclusive micro cap forum focused on micro cap companies (sub $300m market cap). The MicroCapClub was created and founded by Ian Cassel as a way to share ideas and to learn from other seasoned like-minded micro cap investors. Our goal at MicroCapClub.com is quality membership and quality stock ideas. If you are an experienced micro cap investor, feel free to Apply today.

Get Alerted to our Next Educational Blog Post