The Little Things that Result in the Big Things

How does a business get a premium valuation when they sell a commodity?

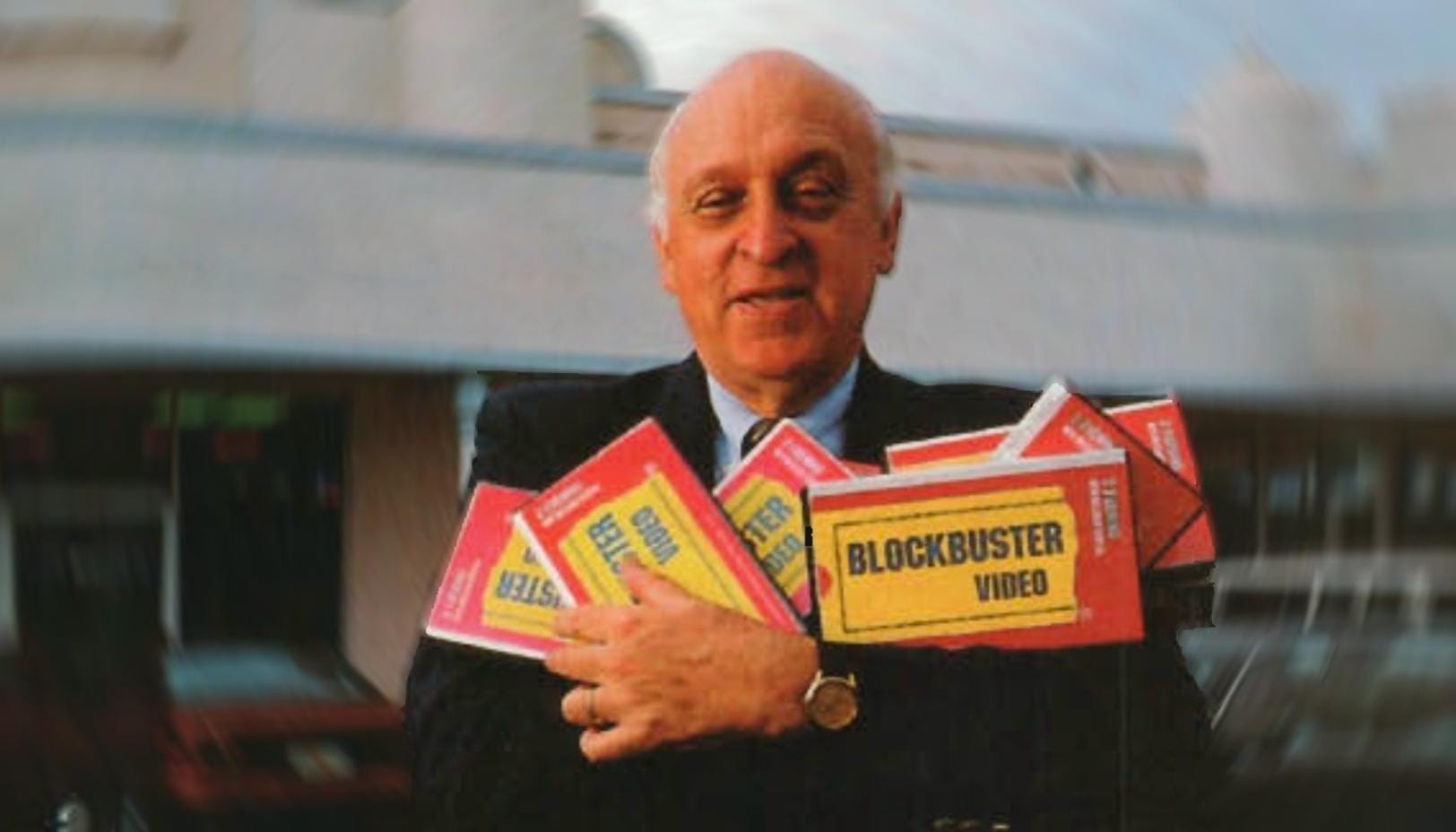

The difference between a good company and a great company is a CEO that executes.

I learned how to invest in microcaps by losing my own money over and over again. I’ve found that the key to successfully investing in microcaps is betting on the right jockey, or in other words, investing in the right CEO. The difference between a good company and a great company is a CEO that executes. The difference between a good stock and great stock is a CEO that executes who is 100% aligned with shareholders interests. The eight habits below are what I find very important, and when you find the CEO that meets all of these criteria, it usually means you found a microcap winner.

Habit 1: Great CEOs treat their shares like Gold: The share structure of a company can tell you a lot about the company and its CEO/management. I find a CEO that treats each share like gold treats each dollar in the bank like gold. Don’t be wasteful. Every dollar wasted just like every share issued represents dilution. Neil Cataldi wrote a great piece on this [HERE].

Habit 2: Great CEOs have meaningful equity positions: I want to invest in companies where the CEO and management own a considerable piece of the company. I like to see management owning between 10-40% of the company.

Habit 3: Great CEOs Purchased their equity positions: There is a big difference between equity positions that are given versus ones that are purchased. I like to invest in companies whose CEO/management have bought their positions. CEOs need to be aligned with the rest of the shareholder base and have real skin in the game and cash on the line, not just their reputation.

Habit 4: Great CEOs buy stock in the open market: I have found that great CEOs are always finding reasons to buy stock in the open market, not finding reasons why they can’t. Too many CEO’s I talk to give me excuses, “Well we are working on some material things and I can’t buy now; We aren’t within in the window that allows us to buy.” These are excuses. The great CEOs always find excuses to buy stock. To CEO’s: I don’t care if it’s only a $1000 insider purchase. It is not insignificant. It means 1000x more than that to investors.

Habit 5: Great CEOs have industry average or lower salaries: I want to invest in a company where the CEO and management team are looking to make their money on their stock position, not off milking the company with high salaries.

Habit 6: Great CEOs communicate with investors but never say too much: I like to invest in undervalued stocks. I don’t like to own undervalued stocks that are always going to be undervalued. I’ve talked to too many CEO’s and management teams that view their shareholders as lepers. I believe it’s a management teams fiduciary duty to let more investors know they exist. This said, the best CEO’s don’t ever say too much, and they don’t give guidance. They never put the company in a position to look bad (i.e. guidance).

Habit 7: Great CEOs know what they know and delegate what they don’t: Too many CEO’s have egos the size of the Empire State building. They think they know everything even though they know they don’t, and this keeps them from success ie wastes time and money. Great CEO’s quickly find people who know the answers.

Habit 8: Great CEOs (sometimes) have a history of success: Many microcap CEO’s are entrepreneurs, so they literally don’t have a long history in which to judge. Microcaps are small businesses so look for entrepreneurial success (founded and sold) rather than big company success (VP at IBM).

If you enjoyed this article, you will enjoy How To Find Intelligent Fanatic CEOs Early.

===> Interact and learn with 250+ of the best microcap investors on the planet. [Join Us]

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit http://microcapclub.com and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire."