Baruch: My Own Story (Buy Here) I’ve always enjoyed business biographies, especially those about successful traders, investors, and entrepreneurs of generations past. Most have read Reminiscences of a Stock Operator, By Edwin Lefevre which was a disguised biography of Jesse Livermore. Jesse Livermore made $100 million ($1.5 billion

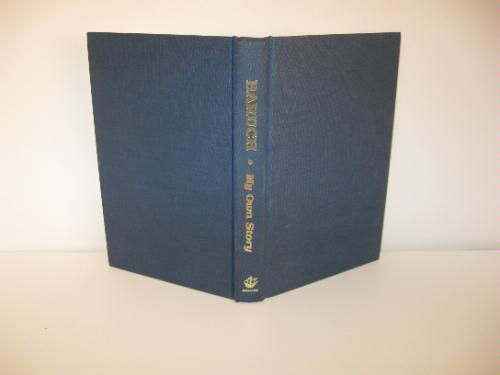

Baruch: My Own Story (Buy Here)

I’ve always enjoyed business biographies, especially those about successful traders, investors, and entrepreneurs of generations past. Most have read Reminiscences of a Stock Operator, By Edwin Lefevre which was a disguised biography of Jesse Livermore. Jesse Livermore made $100 million ($1.5 billion in today’s dollars) shorting the crash of 1929. However, Livermore also lost his fortune just as quick, and committed suicide in 1940. Another trading-investing legend, and also a close friend of Livermore’s is Bernard Baruch (1870-1965). He wrote his memoirs via “Baruch: My Own Story” in 1957. The book reads chronologically through Baruch’s upbringing, finding his career path, early successes in trading (made $1 million by age 30 (year 1900), business partnerships (Guggenheims, and many others), Lessons Learned, Investment Philosophy, Life as an advisor to several US presidents, and of course philanthropy. Of the things you pick up on quickly is unlike Livermore, Baruch never went broke as he had an uncanny sense of crowd behavior on both the long and short side of the market. He was known as the “Lone Wolf of Wall Street” for his refusal to align with any one financial house. By 1910, he was one of the most successful financiers in the world. Most of his dealings were in resources (Copper, Gold, Sulfur, Gold, Rubber, Steel, etc) which helped create a flourishing relationship with the Guggenheims. This knowledge of resources would later be tapped by several presidents to help prepare for two world wars. I felt the book was very educational and very honest. Baruch even goes into detail stating that some of his trading tactics he would use to acquire controlling positions in stocks would now be viewed as illegal. Just like Livermore, Baruch’s favorite book was “Extraordinary Popular Delusions and the Madness of Crowds” By Charles Mackay published in 1841.

Rating: READ IT!

===> Interact and learn with 250+ of the best microcap investors on the planet. [Join Us]

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit http://microcapclub.com and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

Both stock picker and gambler need to develop a systematic approach to become consistent enough to take money from the casino, sportsbook or the stock market over the long-run.

Successful investing isn’t about being right all the time; it’s more about the ability to identify when you are wrong quicker.