Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

99% of the time in investing you need to be a stoic investor. The other 1% you need to be a savage.

The stock market’s job is to find your breaking point. It normally happens when you are the most confident. Mr. Market walks up to you with a sh!t-eating grin on his face. He stands a foot away from you, looks you in the eye, “Oh you think you have conviction, isn’t that cute. We’ll see about that.” Then bam! Something you believe is down 40-50%. Nothing tests your conviction like falling stock prices.

At least once per year I’ll wake up to a position trading down 30% premarket. Some large holder wakes up grumpy and decides today will be the day to sell their entire position in an illiquid stock as quickly as possible.

I always wonder what sparks this rage filled seller. Did they wake up on the wrong side of the bed? Was it a nightmare about the stock? Did the seller find out the CEO flirted with his wife at a cocktail party? Did they get back from a meditative retreat where they became enlightened? Do they hate me personally?

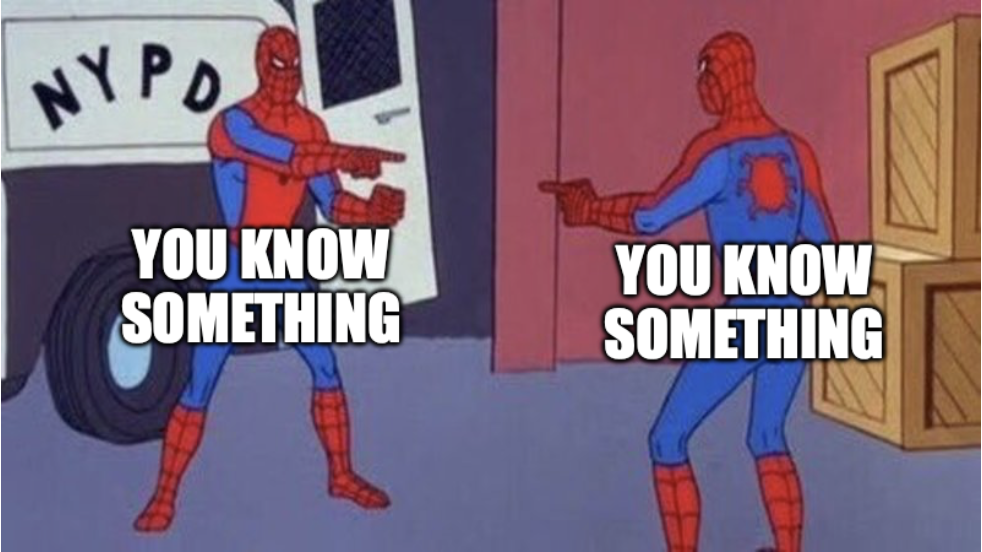

The worst part is they are rude about it. The seller decides to slap some bids in pre-market trading. Indiscriminate pre-market selling scares all the longs. Are they raising capital? Did they lose a large customer? Is it a short report? Accounting irregularities? The market freezes. Everyone is thinking the same thing, “someone knows something”.

By the time the regular session opens for trading there is no bid support. The bid ask spread is a mile wide and Level 2 (market depth) looks literally like Level 2 – two levels of support to Zero.

While pointing at yourself in the mirror you say some positive words of affirmation, “I’m a man (or woman). I’m knowledgeable. I can do this.” You swallow the throw up in your mouth.

You place a buy order below market hoping it doesn’t get hit. But it gets hit. As you stare at the executed trade notification, you throw up in your mouth again. “Well, I don’t need breakfast”.

I had two such situations occur in Q1 of this year. Two positions. Two forced sellers driving the equity down 40% in minutes in one and over a few days in another. It’s hard to catch a falling knife even if you know how. If you are a sizable investor that builds a relationship with management you text the CEO, “What is going on?”. If they text you back, you know it’s nothing. If they don’t text you back, you know it’s something.

The opportunity presents itself for seconds, minutes, hours, or maybe days. While most investors freeze, you are decisive. You buy the pain. The only reason you can find the courage is because you did the work others didn’t do and you trust management. 99% of the time in investing you need to be a stoic investor. The other 1% you need to be a savage.

Then the madness stops. The stock recovers. Everyone that wasn’t buying near the lows starts to buy 30% off the lows so they can mentally tell themselves they bought the dip even though they didn’t buy the real dip.

The art of catching falling knives is determining whether the fall is business or non-business related. If it is non-business related you buy. If it is business related you don’t buy or maybe even sell.

Falling knives can also occur over weeks or months during bear markets in microcaps. Microcap stocks become more illiquid as they drop over longer periods of time. Why? The long-term holders run out of money or conviction to buy more lower.

We’ve all been there in a position. It isn’t a drawdown until you start hesitating to buy something you believe in lower. You loved it 20% lower but not 50%. When you are down 50% off the highs you start thinking, “Let me see how this shakes out first”. It is in that moment in time you would rather buy it 50% higher than another 20% lower. You can’t handle being any more wrong than you are right now. That feeling of mental and emotional exhaustion – that is the low in the stock.

This is so savage and true. Written in 1930.

“The day you sell is reasonably certain to mark the end of the decline, because you are not the only one who was finally scared into selling. You, being an average man, were merely representative.”

Fred Kelly

===> Interact and learn with 250+ of the best microcap investors on the planet. [Join Us]

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 900+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit http://microcapclub.com and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.