High Conviction

High concentration doesn't mean sizing big in the beginning. It means letting winning positions get big in the end.

An exclusive community of 250+ experienced microcap investors. We've profiled 300+ multibagger stocks. Not a guru service — a collective of the world's best stock pickers doing the work Wall Street won't.

Buffett, Lynch, Greenblatt — almost every legendary stock picker started here. MicroCapClub is the home of the best microcap stock pickers on the planet. We work together to surface actionable ideas hiding in the most overlooked corner of the market. No hype. No pump and dumps. Rigorous, community-driven research from investors with skin in the game.

Source: Jenga Investment Partners — Global Outperformers Research

We don't sell hot tips. We curate an ecosystem. Every member is vetted. Every thesis is rigorous. Every discussion is meaningful.

Only 17% of applicants are accepted. Every member submits a 2–3 page investment thesis and is voted on by existing members. Quality over quantity.

300+ multibaggers profiled since 2011. Our Member Ranking System tracks every pick publicly. Performance is transparent, not claimed.

1,500+ companies profiled across US, Canadian, European, Australian, and Asian markets. Deep value to hypergrowth — every flavor of microcap investing.

250+ fund managers, private investors, and allocators sharing ideas. This isn't one analyst's newsletter — it's collective intelligence at scale.

10+ new ideas per month. 100+ active discussions at any time. Real-time alerts when companies get profiled. The conversation never stops.

All members and subscribers get access to Planet MicroCap conferences and virtual events. Where online community meets real relationships.

MicroCapClub is an invaluable source of idea flow, networking, and a great place to build a reputation among some of the best micro-smallcap stock pickers from around the world.

If you are serious about exposing yourself to the best investors and the best investment ideas in the microcap space, you need to make it a priority to join MicroCapClub as soon as possible. Trust me on this.

As a microcap fund manager, I regularly participate on MicroCapClub to source and share company ideas and collaborate with experienced microcap investors.

Whether you're a newcomer or a seasoned investor, I wholeheartedly recommend joining MicroCapClub — its unmatched community sets it apart from the rest.

The MicroCapClub is a valuable resource for anyone passionate about investing in micro-cap stocks. Ian has consistently chosen quality over quantity. What really makes the Club special is its culture — characterized by openness, curiosity, and collegiality.

MicroCapClub is where I've found my best ideas over the past decade. The quality of discourse is unmatched — every member has real conviction and real capital behind their picks. It's the only community I've stuck with.

Whether you're a proven stock picker who wants to contribute, or a serious investor who wants to learn from the best — there's a path for you.

In 2026, MicroCapClub acquired Planet MicroCap to unify the best online and in-person microcap experiences. No sea of service providers. Real investors, real companies, real conversations.

Ian Cassel started investing as a teenager. In 2009, at the age of 28, he was a full-time private investor supporting his family on his own capital. In 2011, he founded MicroCapClub.com, a global online community for experienced microcap investors to find new ideas, collaborate on due diligence, and network with peers. Today, MicroCapClub is recognized as the thought leader in the microcap space.

How to develop the mindset, temperament, and strategy to outperform Wall Street.

Pre-Order Now →Educational articles written by full-time investors — business breakdowns, interviews, and presentations. Join the largest microcap newsletter in the world.

High concentration doesn't mean sizing big in the beginning. It means letting winning positions get big in the end.

Where the best in microcap gather, connect and grow.

You can listen/watch this conversation on Spotify, Apple Podcast, and YouTube.

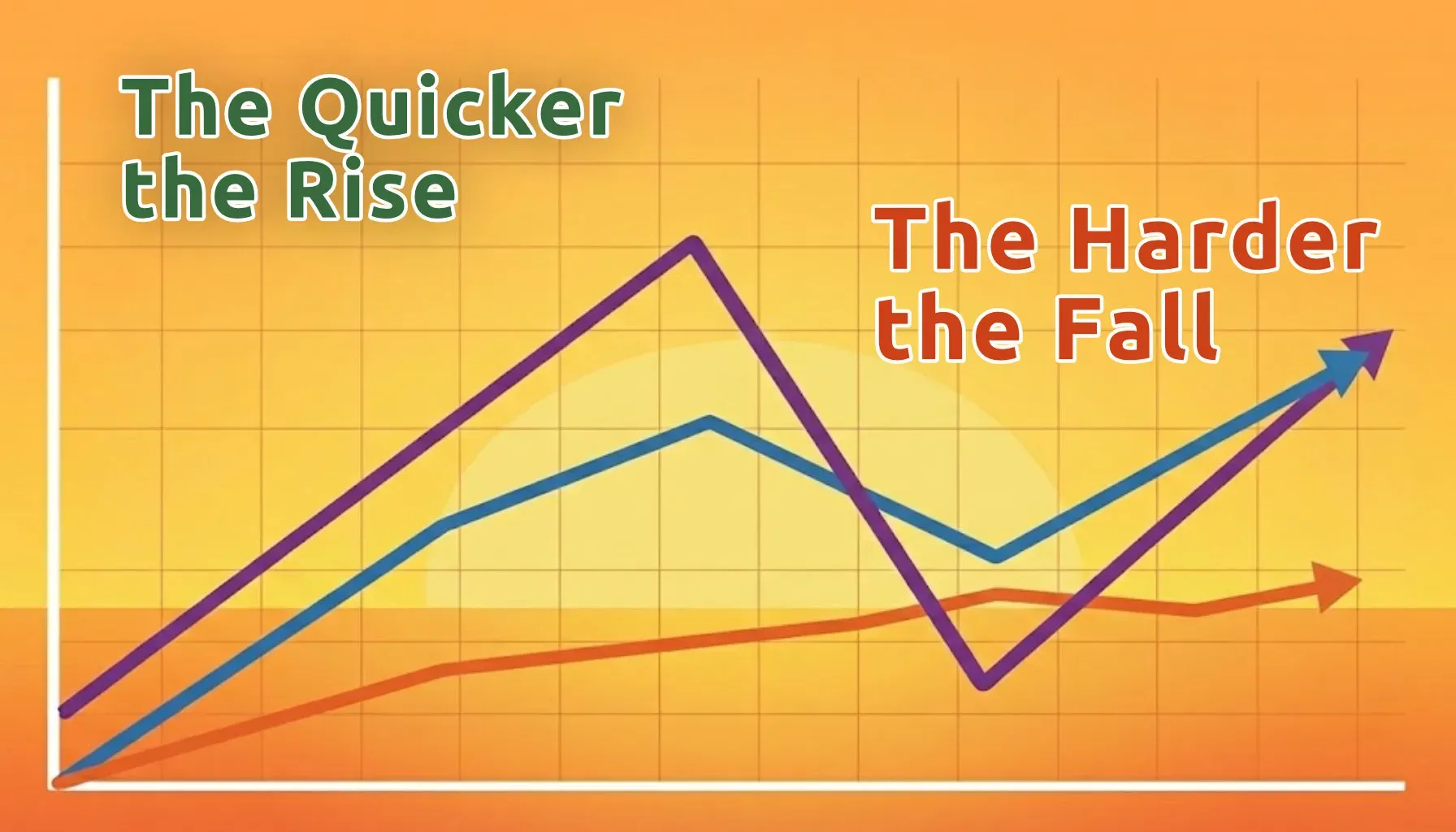

Microcaps have larger peak to trough drawdowns when compared to largecaps. What can we learn from them?

You can listen/watch this conversation on Spotify, Apple Podcast, and YouTube.

You can listen/watch this conversation on Spotify, Apple Podcast, and YouTube.

250+ experienced investors. 300+ multibaggers. 1,500+ companies. The most respected microcap community in the world.