“We may impress people with our strengths but we connect with people through our weaknesses” – Craig Groeschel

Talking about your winners all the time might lift the ego and attract lemmings, but it will do little towards gaining the respect of your peers. I picked the right stock, it went

Microcap companies make up half of all publicly traded companies on all the US exchanges, including the OTC Markets and OTCBB. Microcaps have always been under appreciated by a bulk of investors and especially the financial press. Even most professional investors I talk to don’t realize the size and

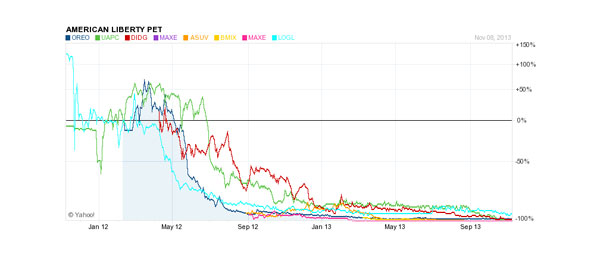

Pump and dumps have been going on since the beginning of the stock market and are most prevalent amongst penny stocks. The hard mailer is one of the most used avenues to pump a stock. The company themselves, affiliates, or large shareholders pay millions of dollars to mail out glossy

The current market environment is creating potential opportunities for investors seeking alternative options. These investors can benefit from a discussion comparing active microcap investing and private equity. The topic is a timely one, especially as it pertains to longer-term investment approaches.

Investors look to microcap investments for possible alpha generation

Heartland Funds published this white paper on microcaps earlier this year with some good historical data points on the microcap space. The Heartland Value Fund (HRTVX) is a value based micro-smallcap fund. The fund’s average market cap in the portfolio is $472 million.

Historical Micro-cap Returns

Over time, micro-caps

Congratulations to Mike Schellinger (aka MikeDDKing) for taking first place in our MicroCapClub Stock Contest with a cumulative return of +156% in his portfolio of microcap stocks. Mike is one of the most successful microcap investors I know, so this was not a surprise.

Mike’s Prize for Winning: $2,

In a spinoff, securities of some company shows up in your brokerage account. You didn't ask for it, you didn't buy it, and you may know very little about it.

Bob Auer is Senior Portfolio Manager of the Auer Growth Fund (AUERX). The Auer Growth Fund is 65% in micro-smallcap equities and according to Morningstar ranks in the top 1% for performance over the last 12 months. The interesting thing is the fund isn’t a microcap-centered fund, but a

A few weeks back I was sitting around the campfire with my wife and children and we were playing a pattern matching game. Later that evening I was watching and helping my three year old son with a puzzle which is another pattern matching activity. After the activities of that

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,