Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

Due diligence that goes above and beyond can often give you an edge that can yield large returns in the microcap space. Most astute investors read quarterly and annual financial statements, but I find very few go beneath this first layer of due diligence. In a four part series Sean,

The microcap space is filled with bad management teams, and over the years as an active investor I’ve witnessed and experienced interesting behaviors from company officers. As part of my due diligence, I visit quite a few companies and meet with their management teams 1×1. I used to

DGHM recently published a white paper on microcaps that studies microcap performance vs private equity and also analyzes microcap performance coming out of a recession. It’s important to note that for this paper DGHM defines microcap stocks as deciles 2-3 (mkt cap $275m-$894m), as decile 1 (sub $275m)

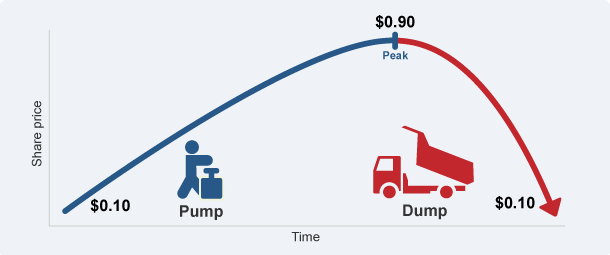

A hard mailer is nothing more then a pump and dump. The company themselves, affiliates, or large shareholders pay millions of dollars to mail out glossy 20 page reports trying to dupe investors to buy the underlying stock so they can sell their positions. Just like Gravity, when a hard

I stumbled upon this RBC white paper on microcaps this morning. The paper hits on a few topics on why microcaps are so unique and why they are such an opportunity. The U.S. microcap equity market is comprised of the smallest publicly traded and investable companies in the United

Accredited investors may from time to time participate in private placements in US and Canadian listed microcap companies. A company needs funding, you write a check, and the company issues you restricted stock. The length of the restriction is different for US vs Canadian listed companies. An investor participating in

How do you create a publicly traded microcap? IPO a small cap and lose a lot of money. Quite a number of microcaps came to be in just this manner. A recent personal acquisition of just such a historical money-loser inspired this article. Some math was required to evaluate what

I became a full time microcap investor in October 2012, after working on Wall Street for 16 years across research, trading, institutional investment management and client service jobs. Early on in my career, I worked as the sole analyst for a microcap investor who ran his own firm. It was

MicroCap executive compensation is a topic that has been brushed under the rug for quite a while. I’m not an executive compensation expert, but I have invested in over a hundred microcap companies over the years. As a full time microcap investor, there have been plenty of instances where