Wasatch Funds published this white paper which gave some interesting statistics on global smallcaps. One of the most interesting areas is their analysis of smallcap stocks in developed vs emerging markets/countries. Even though this white paper is geared towards smallcaps I think it is also relevant to microcaps.

Click

The Brandes Institute published this white paper on Global MicroCap stocks last month. I think you will find it very useful and interesting except for the fact they left out all the microcaps on the OTCBB and OTC Markets.

Click To View

===> Interact and learn with 250+ of the

The current market environment is creating potential opportunities for investors seeking alternative options. These investors can benefit from a discussion comparing active microcap investing and private equity. The topic is a timely one, especially as it pertains to longer-term investment approaches.

Investors look to microcap investments for possible alpha generation

Heartland Funds published this white paper on microcaps earlier this year with some good historical data points on the microcap space. The Heartland Value Fund (HRTVX) is a value based micro-smallcap fund. The fund’s average market cap in the portfolio is $472 million.

Historical Micro-cap Returns

Over time, micro-caps

DGHM recently published a white paper on microcaps that studies microcap performance vs private equity and also analyzes microcap performance coming out of a recession. It’s important to note that for this paper DGHM defines microcap stocks as deciles 2-3 (mkt cap $275m-$894m), as decile 1 (sub $275m)

At MicroCapClub we enjoy looking at microcap success stories so that as investors we can learn and try to formulate a blueprint of success for future investing. There have been several microcaps over the last few years that have gone from sub $1.00 per share to double digits ($10+

Contango Oil & Gas (MCF) has been one of the real microcap success stories over the last 12 years. CEO Kenneth Peak is a bit of a rockstar in the smallcap oil & gas industry and rightly so. The company has gone from $0.20 in 1999 to $59 today.

In Part 1 of this series, I wrote about why investors should pay close attention to microcaps that choose to get smaller via dispositions. I then wrote Part 2: Broadway and Seymour, and Part 3: Clearfield Inc which showcased examples of value that was generated via dispositions. In this writeup,

In 2010, Dr. Gerald Perritt, Founder of microcap fund bellwether, Perritt Capital Management wrote the following piece, “The MicroCap Advantage”. Dr. Gerald Perritt has since sold Perritt Capital Management to Michael Corbett whom I interviewed recently. In “The MicroCap Advantage” posted below, Perritt makes his point that extraordinary returns have

In Part 1 of this series, I wrote about why investors should pay close attention to microcaps that choose to get smaller via dispositions. In Part 2, I described a Case Study of Broadway & Seymour’s sale of their money-losing customer relationship management software business. This uncovered the profitable

In Part 1 of this series, I wrote about why investors should pay close attention to microcaps that choose to get smaller via dispositions. In this follow on article I will take you through a real world example of a company successfully choosing to get smaller and how investors (me

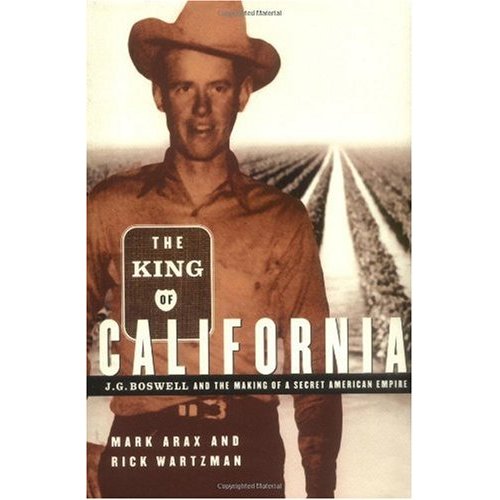

JG Boswell Company (BWEL.PK) is perhaps the most interesting micro cap company you never heard of. This $700 per share, $650m market cap, non-reporting pink sheet company is the largest cotton farmer in America and known as the worlds largest privately owned farm. The farming operation consists of ~150,