Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.

In 1951, at the age of 21, Warren Buffett put 53% of his portfolio into GEICO and wrote up his thesis in The Commercial and Financial Chronicle. Buffett would make a quick 50% return in a year - turning $10,282 ($122,000 in today’s dollars) into $15,259 ($180,000). Not bad for a young 20-something. He sold GEICO and put the proceeds into a cheaper stock. This was part of a five year run where Buffett would average ~50% annual returns, growing his capital 10x breaking the $100,000 mark, equivalent to $1 million today.

I think about this story quite often. Not the GEICO part. Not the concentration part. Not “the first million” part. It’s the fact he wrote up GEICO and published an article after he bought a position. Even the Oracle of Omaha talked his book. He is the same as us.

We love to talk our book and tout them on social media, blogs, substacks, spaces, 1950’s newspapers 😊, even private forums like ours. Our positions and convictions are like our children. We must promote them. We feel it’s our duty to be the change agent that unmasks a wonderful opportunity to the world.

We want to help nudge, push, force the stock price closer to our estimate of intrinsic value.

We prefer to have tomorrow's gains today and not wait around for time to prove us right.

But we are long-term investors.

As we accumulate a position, we curse the stock for moving higher, and as soon as we are done acquiring the position, we curse the stock for not immediately moving higher. We are all “long-term” investors that prefer our gains come as quickly as possible.

But we are long-term investors.

We do exhaustive research and analysis to find that one company where we can form a 1–3-year variant view. We take a position and wait. When the stock doesn’t move for 6-months we start questioning everything.

But we are long-term investors.

Holding winners is difficult because you keep looking back at your cost basis instead of looking forward at the business. When you are standing on top of Mount Everest all you can see is what is beneath you. It’s hard to imagine the climb is just beginning.

But we are long-term investors.

Microcap management teams that can execute are rare. We spend 95% of our time looking for any excuse to sell our winners instead of selling our losers.

But we are long-term investors.

We love to dabble in our positions. Add a little bit here and sell a little bit there and in the end, we conclude we would have been better off focusing on making fewer bolder decisions instead of a thousand smaller ones. We love to think that activity equals productivity. We hate being bored.

But we are long-term investors.

We do a ton of work identifying a wish list of businesses we would buy if they were cheaper. The stock market finally has a correction, and we hesitate. We sit there sucking our thumbs. “Let’s see how things shake out first.”

But we are long-term investors.

When a microcap stock moves against us in the short-term, we like to blame management. Management isn’t telling the story correctly. Why hasn’t the investor relations page been updated with the latest investor deck? Why aren’t insiders buying? Normally nothing fundamental has changed. The stock is down 20% because someone decided to sell $50k worth of stock to pay for a wedding, college, any number of reasons. Short-term volatility in life, business, and markets bring out who we really are. Apply a little pressure and our façade crumbles. Our true conviction (or lack thereof) is seen.

But we are long-term investors.

We see a CEO sell some stock after it runs 200%-500%-5,000%. We get alarmed and start questioning him/her. We forget they have children in college. We forget they have new memories they want to make with their kids and grandkids with a new lake house, boat, etc. We forget that taking a little bit off the table and enjoying life a little more makes us more productive (not less productive). We forget that 100% of us would sell if we were in their shoes.

But we are long-term investors.

The investor that worries about “next quarter” will sell at any sign of imperfection. Since no company is perfect, it means we always sell winners too soon. More importantly, it's a bad sign whenever you start worrying about "the next quarter" because it proves you don't have enough conviction to look past "the next quarter".

But we are long-term investors.

As self-described long-term investors we are all faced with these situations hundreds if not thousands of times. What has helped me is being self-aware of my own emotional and phycological delusions. Human nature can be hilarious. We love to do the wrong thing at the wrong time. Sometimes I just sit back and laugh at what I’m feeling. The only thing that has changed over time is how I react to what I’m feeling. It's often how you react (or don't) to the same situations that shows you how much you’ve grown. But just like Buffett, I probably won't stop talking my book.😁

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

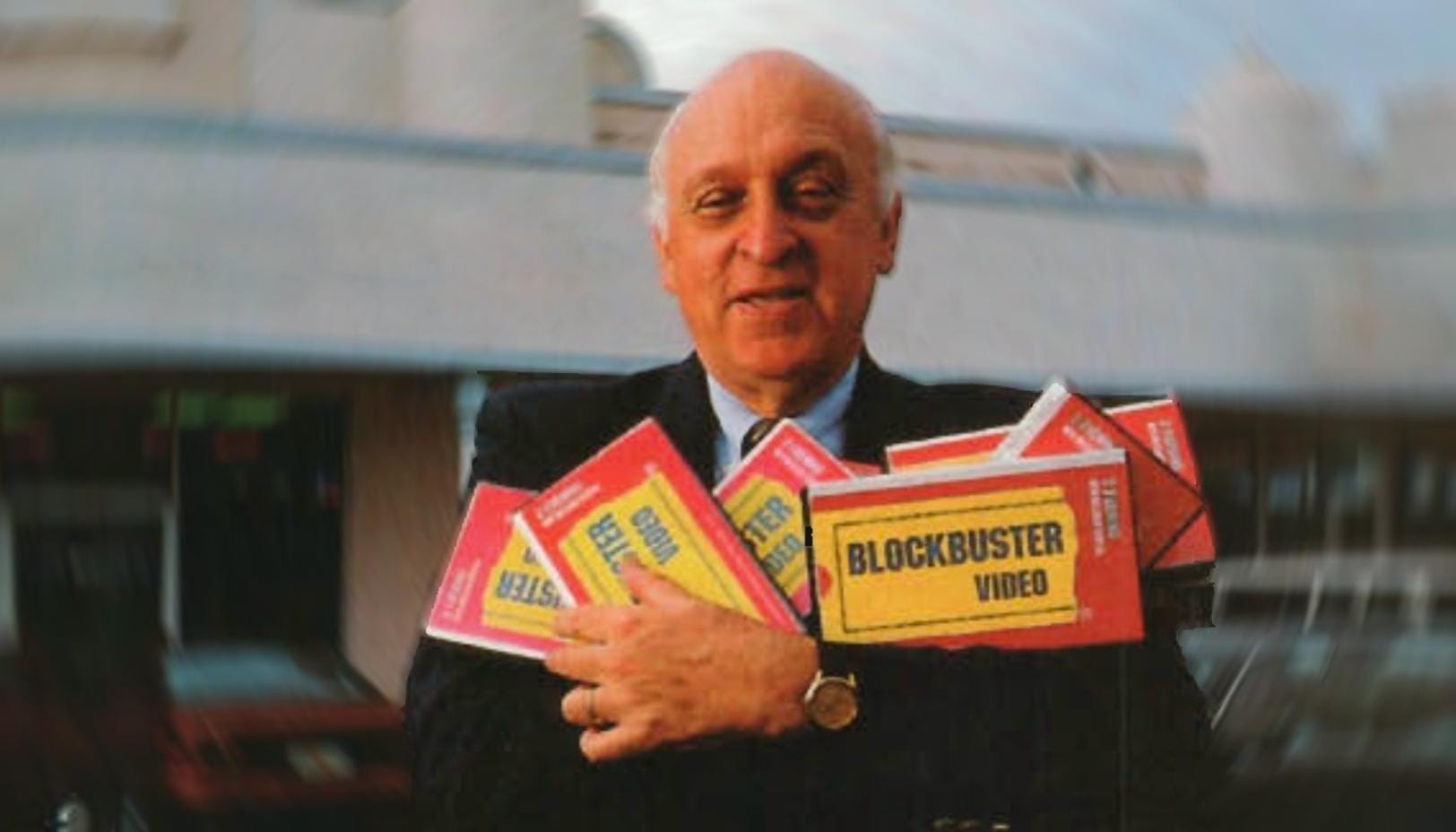

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire."