Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

One of the core things Sean Iddings and I noticed from studying intelligent fanatics was that transformative business leaders excel in industries that most would consider low-margin, mundane, or outright disliked.

Take, for example, Herb Kelleher at Southwest Airlines, Ken Iverson at Nucor, Sol Price at FedMart, Les Schwab at his tire centers, Robert Kierlin at Fastenal, and Ingvar Kamprad at IKEA. I could rattle off another ten intelligent fanatics that created dominant businesses in unglamourous industries.

These leaders mastered the art of sweating the small stuff. Their relentless energy, commitment, and focus on doing small things at an exceptional level led to their success. They showed that even the most unglamorous fields are ripe with opportunity for those that push the boundaries of the status quo.

Mining might be the most hated and under allocated industry of our generation. Nowhere is the need for thoughtful attention more necessary to succeed. Investing in mining is hard.

In Chris Mayer’s book, How Do You Know?, he gives a great example from an article written by O’Higgins Asset Management to illustrate this point.

“Suppose that on January 31, 2006, you knew with certainty that the price of gold would more than triple over the next five years, from $569 per ounce to $1,900 per ounce. Knowing that, might you have invested in Newmont Mining, the world’s second-largest gold producer? Odds are high that you would have gladly bought Newmont Shares. What that kind of surge in the price of gold, buying in one of the world’s largest gold companies would seem like a no-brainer. Yet, the share price of Newmont fell 5% over that time.”

Yet, amidst these challenges, intelligent fanatics are working under the radar, transforming their industries in quiet yet impactful ways. They are tough to spot because they often operate discreetly in unloved industries or are misunderstood by the broader market. However, discovering such individuals can be incredibly rewarding as they have the potential to keep compounding for decades.

In 1985, Franco-Nevada (FNV) co-founders Seymour Schulich and Pierre Lassonde approached their investors with a new gold royalty business plan. Investors didn’t exactly love the idea. They were only able to raise $930,000 in a secondary offering.

But by 2001, Franco-Nevada (FNV) shareholders had realized a 38% compounded annual return over 16 years or a return of 173x their initial investment. A phenomenal accomplishment in an industry known for capital destruction. What is even more impressive is the price of gold dropped during this period.

In resources it’s normally not the resource but the people that are the true “precious metal”. It’s the people that find the resource, develop a plan, finance the plan, and allocate capital, to grow and survive. It’s the people that unlock value.

I would like to highlight a real-world microcap example to drive a point home, not to drive the stock up. Caveat emptor. This is an excerpt from my IFCM Q1 2024 letter.

Idaho Strategic Resources (IDR) is a profitable Idaho based gold producer that also owns the largest, rare-earth element (REE) and thorium land package in the United States. I’ve owned the stock since 2013.

IDR is a unique resources company in the public markets. It’s the only public company that can give an investor exposure to both gold and rare earth elements in one investment vehicle. Investor appetite for both of these resources is increasing, and IDR is a one of one way to play those tailwinds. But the real differentiator is that it’s run by an exceptional operator in John Swallow. He's also the largest shareholder.

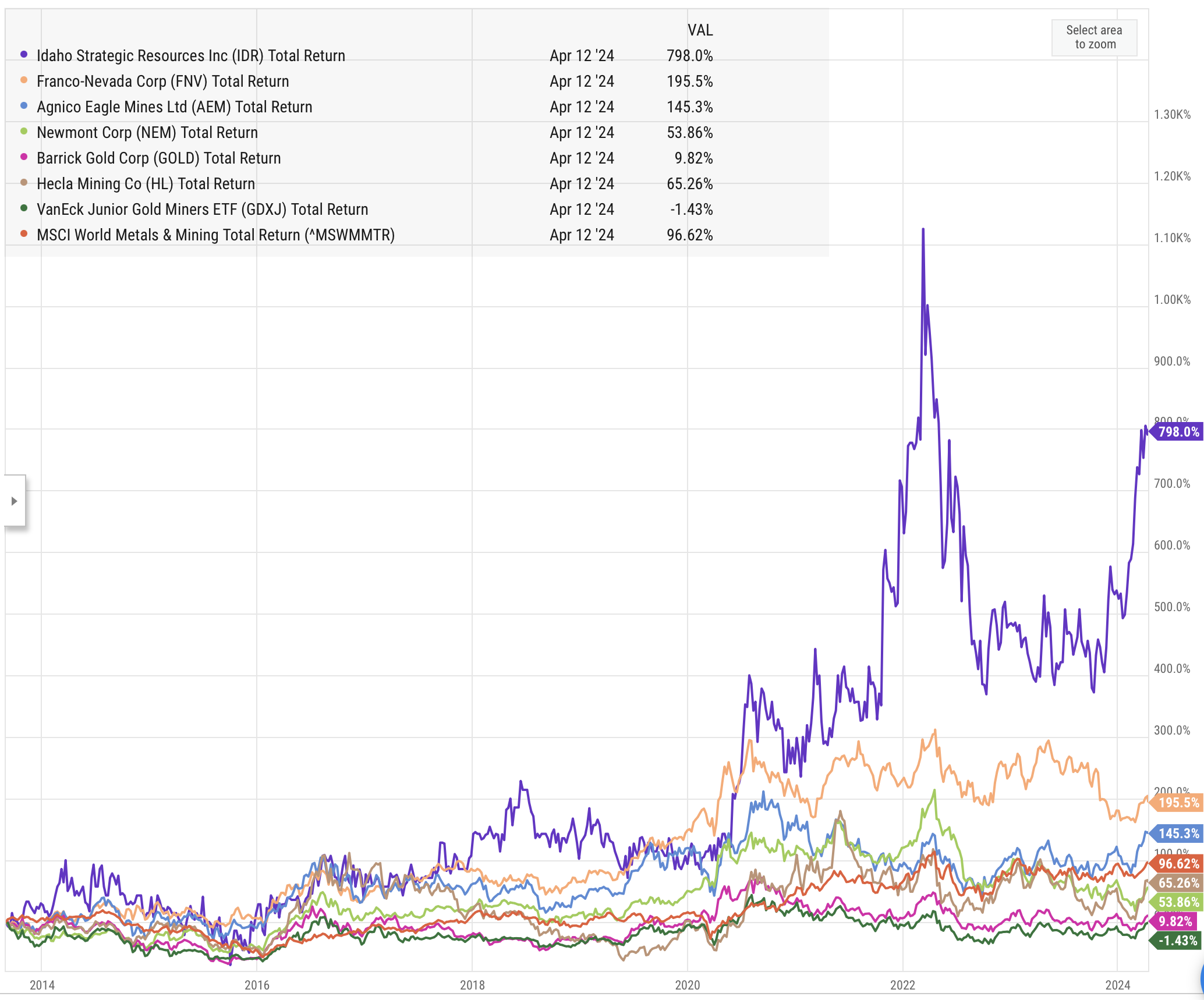

All public company CEO’s have a report card. It’s called a long-term stock chart. Here is John Swallow’s report card since becoming President of IDR on August 30th, 2013, versus the industry. The price of gold is up 75% during this time period.

When I initially bought shares in IDR a decade ago, I didn’t do so because I held some macro view on fiat currencies or inflation. I bought the position because of the people. Over the past ten years John and his team built a company under the radar and acquired assets when no one wanted them. They built the business when the price of gold was 50% lower than it is now. Fast forward to today - IDR has the right assets in the right place at the right time.

Resource companies can trade at 5x or 100x PE’s (Price/Earnings) depending on sentiment and growth expectations. Even large miners like Newmont and Hecla don't even have an “E” right now due to layering on so much debt. I would estimate IDR is trading at 25x my 2024 earnings estimate. I think it’s undervalued.

I know some of you are thinking. I can buy XYZ gold producer at 10x earnings.

It begs the question - Should all gold mining companies be valued the same way? Are all ounces created equal?

Are ounces mined in the United States worth more? Where there is rule of law, private property rights, and no threat of government nationalization. Yes, those ounces are worth more. IDR is a US based gold producer.

Are ounces mined where employees go home to their families every night worth more? Most miners work on 6-month contracts and are forced to work away from their families (even in Nevada). It leads to addictions, divorce, and broken families. Yes, going “home” at night is worth more. IDR miners go home to their families every night.

Are ounces mined in a known mining friendly state worth more? Good luck trying to build a mine in California or Montana. Yes, being in a mining friendly state is worth more. It’s easier to get things done. IDR’s mine and REE properties are in Idaho – the 7th most mining friendly jurisdiction in the world.

Are ounces mined in a beautiful location (not in a desert or frozen tundra) worth more? Few people want to work where most mines are located. Many mining companies have to build a town in the middle of nowhere. Logistics are a nightmare. Yes, mining ounces in a beautiful location where people actually want to live is worth more. The infrastructure, industry, and communities are already in place. It was done naturally.

Are ounces mined from a profitable gold producer worth more? Yes, when a mining company is profitable, they don’t have to dilute to explore. In addition, most major discoveries aren’t discovered by “exploration”, they are found by “mining into something”.

Are ounces mined from a company that has a culture worth more? IDR has a waiting list of miners wanting to work for them. They have six father/son combos. They have 20 additional miners from the same families (uncles, brothers, nephews, etc) working out of 50 miners. IDR has a unique incentive system that helps drive allignment. This is a huge advantage.

Are ounces mined from a company that also owns the largest known REE and Thorium land package in the United States worth more? Yes, it provides an unquantifiable upside to the business.

Perhaps the most important - Are ounces mined from a management team you can trust worth more? Yes, they are extremely rare in the mining industry.

It’s all these little things that add up to big things that are hard to duplicate. But let me attack this from a slightly different angle.

Why does Costco trade at 2-5x the multiple of other discount grocers? They all sell the same low margin stuff just packaged and branded differently. No offense to the Kirkland brand.

It's all the little things Costco does right. It's the culture, the values, the history of treating customers, employees, partners right and fair. It’s the $1.50 hot dogs. Costco members pay $60 per year for the right to spend money in Costco stores. The Costco strategy is well known. The competition knows what Costco is doing, even how they do it, and they still can't duplicate it. It's all the little things that taken together are big things that are insanely hard to duplicate unless a company was built on a certain bedrock of values.

Isn’t this the ultimate moat?

Especially in industries that are often viewed through an unfavorable lens like mining and resources. It's all these little things that make an investor feel good about investing in these areas, instead of bad. This is how you gain a premium valuation for selling a commodity. You can find "cheaper" things that give you the same exposure, but they aren't as valuable.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire."