Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

Last year on History Channel’s “Pawn Stars”, a gentleman named David walked in with a guitar case. Rick Harrison, owner of the shop and star of the show, inquired, “What do we have here?” As David opened the case, he calmly stated, “It’s a 1963 American-made Fender Stratocaster.

Last year on History Channel’s “Pawn Stars”, a gentleman named David walked in with a guitar case.

Rick Harrison, owner of the shop and star of the show, inquired, “What do we have here?”

As David opened the case, he calmly stated, “It’s a 1963 American-made Fender Stratocaster. But there is something very, very special about this Strat. This guitar was played by Jimi Hendrix.”

Rick’s astonishment was evident as he exclaimed, “That’s a big wow factor right there.”

This guitar’s narrative transformed from being a rare, well-preserved ‘Strat’ that rested quietly in a closet for six decades to becoming an ultra-rare artifact of rock history commanding significantly more demand.

Consequently, the value adjusted accordingly. A nearly identical ‘63 Stratocaster could be acquired for $35,000. However, given Jimi Hendrix owned and recorded on this particular guitar, it’s worth soared to a range of $750,000 to $1,000,000.

A thirty fold price differential, all attributed to the power of the narrative.

Narrative drives price.

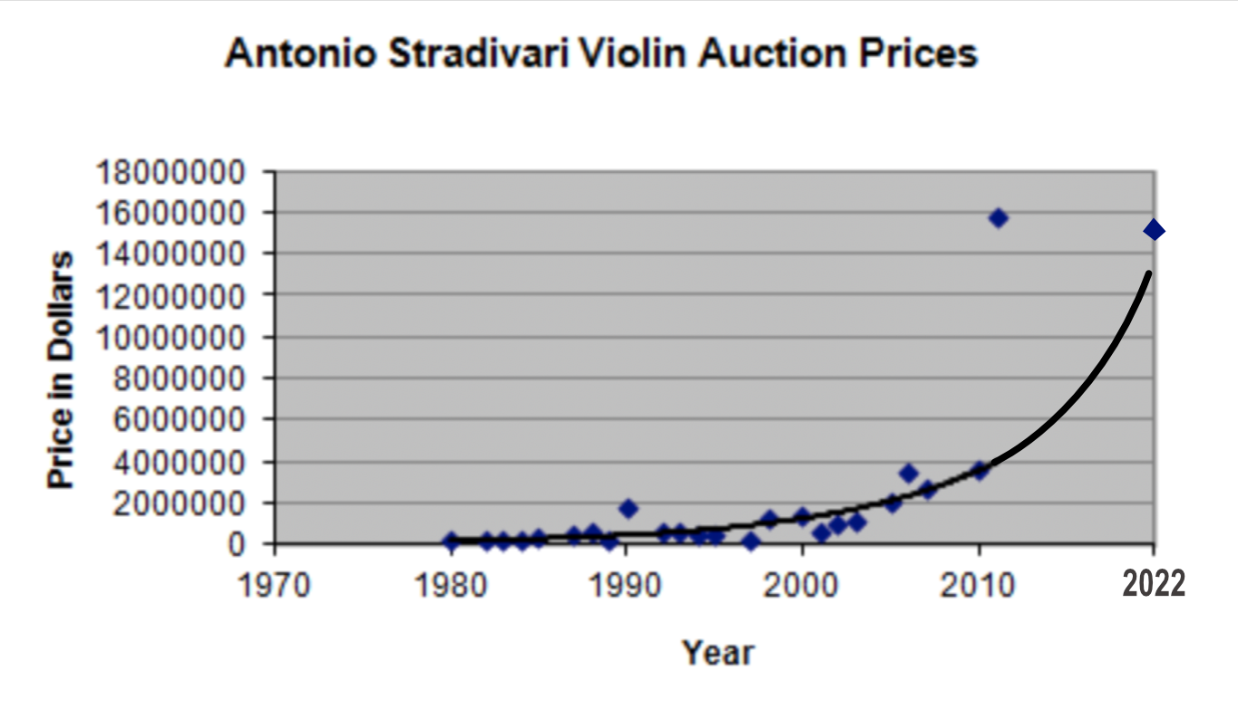

In 2001, Joshua Bell, violin virtuoso, was in London to play a concert at the Royal Albert Hall. Bell needed some new strings, so he went to the famous violin shop J&A Beare. Upon entering, he saw the owner coming out of the back room with a stunning violin. The owner told him that it was the famous Huberman Stradivarius violin.

Bell was floored. He had played that violin once before when it was owned by violinist Norbert Brainin. This violin had a remarkable history. It was one of six instruments made in 1713 by legendary violin builder Antonio Stradivari. And this particular violin was owned by a few world famous violinists, most notably Bronislaw Huberman.

During the early 1920s, Bronislaw Huberman was one of the most celebrated musicians of his time. During Hitler’s rise to power, Huberman established the Palestinian Orchestra hiring Jewish artists throughout Europe, giving them and their families impossible-to-get exit visas to Palestine. To raise funds he partnered with Albert Einstein in 1936 doing a tour throughout the US. It was a success and helped many families escape the Holocaust.

Bell later said after purchasing the violin, “It is overwhelming to think of how many amazing people have held and heard it (this violin). When I perform in Israel with the Israel Philharmonic, I am always touched to think how many of the orchestra and audience members are direct descendants of the musicians Huberman saved from the Holocaust with funds raised by concerts performed on the very same instrument I play every day.”

How much did Josh Bell pay for the Huberman “Strad”? In 2001, he paid $4 million. For comparison, a high-end modern handcrafted violin by Joseph Curtin cost around ~$30,000 during that time.

This represents a substantial 130-fold difference in price, largely due to the narrative surrounding the Stradivarius. But the narrative behind Bell’s Stradivarius isn’t just who played it; it’s also about the maker.

Since the early 19th century violins crafted by Antonio Stradivari have a reputation as the finest violins ever made. They carry an aura that rivals the legendary sword Excalibur. Renowned violinists often assert that Stradivarius violins are tonally superior to every other violin. Some attribute this unique sound to the wood Stradivari used, which was significantly more dense due to the Little Ice Age, a period of lower average global temperatures from 1300 – 1850, which hit hard in Europe.

Certain scholars even suggest that Antonio Stradivari treated his wood with special chemical concoctions to achieve that distinct tone. However, double-blind studies conducted amongst violinists and audiences have revealed that both can’t consistently distinguish a Stradivarius from a modern hand built violin. Furthermore, many violinists tend to prefer playing and listening to modern violins as opposed to the pricey Stradivarius violins.

None of the above matters with a strong narrative. Joshua Bell’s Stradivarius is likely worth >3x more today than he paid, based on auction prices of similar Stardivari violins.

As both Jimmy’s Strat & Josh’s Strad demonstrate, humans value narratives. Nearly identical items can be valued at wildly different prices if a strong narrative is attached.

The above stories are also extremes. But narratives drive demand and prices all around us from the ketchup we buy, to where we vacation and cars we buy.

Now you may think, “You are talking about brands.” Well, yes, but brand is only the tip of the iceberg. Brand is the symbol, name, term or design that allows one to differentiate two like items from each other. Narrative is the story behind the brand, the engine that drives people to choose one from another. It’s also the engine that allows the owner to raise prices ad infinitum without losing customers and growing supply.

Take LVMH, for instance. They own some of the world’s strongest luxury brands and have spent decades building their narrative. And boy do they care about their narrative. They spent a whopping 28 billion Euros (35% of revenues) on marketing & advertising alone in 2022.

The narrative engine for LVMH is status. Humans are inherently social creatures, and our place within a social hierarchy or group has historically been crucial to our survival and well being. LVMH solves this social hierarchical insecurity with goods that place people at the top of the social group.

This narrative allows LVMH to maintain the highest prices and to hike prices every year, well beyond inflation, and customers don’t think twice. For example, the price of a Louis Vuitton Toiletry Pouch increased 341% from 1991 – 2021. Nearly all of Louis Vouitton’s goods (see HERE and HERE) increased by >5% CAGRs over the same time period. That was well beyond the 2% inflation rate of Europe and the US.

See’s Candies has built a strong narrative in Southern California. Unlike LVMH, See’s doesn’t have to spend much to build their narrative. See’s is embedded in the So Cal culture. Want to woo or win over a loved one? Get them See’s. Want to share happiness and nostalgia with your kids? Get them See’s. Whether it is the warm fuzzy feelings you felt growing up eating See’s or the joy you receive giving See’s chocolates, it is a regional tradition for more than 39 million people.

See’s strong narrative has allowed Warren Buffett and Charlie Munger to raise prices every single year since taking over See’s in 1972. From ‘72 to ‘82 they raised prices ~10% per year, while inflation soared to 7%. Then from ‘82 to today, See’s has increased prices ~4.5% per year, while inflation has hovered around 2% without losing business.

The narrative of these companies are rooted in an organic, compelling value proposition. They scratch a deep itch. The Stratocaster played by Hendrix is as unique and priceless as the legendary guitarist himself, reflecting the profound impact he had on both music and culture. The same is true with the few Stradivarious violins still in existence. By owning either you are becoming one with key moments of history that left a lasting mark on the landscape of human culture.

Consider, for a moment, no value proposition such as those found in many microcap companies, often called story stocks. Many fail to address a genuine need and are forever unprofitable. Instead they serve as conduits channeling investors’ capital into the pockets of their management. Such a narrative is one that would scarcely attract a cent of investment. So an enchanting story, where authenticity is eclipsed by contrivance, is meticulously crafted. Unlike a true organic narrative, these story stocks are mere mirages or illusions like footprints in the sand, easily washed away by the tide of time, leaving little trace behind.

Compare the organic, robust value proposition of See’s, LMVH or the Strats and Strads with the contrived Beanie Babies story. Ty Warner, Beanie Babies creator, tried to mass produce scarcity. The public was told Beanie Babies were rare. Customers bid up the prices. In reality, the toys were mass-produced, so beyond the earliest generations, few were actually rare. Over time people realized they were bamboozled and the Beanie Baby craze fizzled.

Pan American World Airways (Pan Am) lacked a robust narrative. Pan Am was one of the most iconic airlines of the mid-19th century. Pan Am’s early aircraft were large luxurious aircrafts called “Clipper Ships,” an homage to the elegant clipper ships of the past. Juan Trippe, Pan Am’s founder, deliberately chose this nautical-theme to create an air of romance and adventure around air travel.

Initially, the story worked as air travel was only open to the elite few. But as commercial aviation expanded, air travel became less exclusive. Pan Am’s value proposition vanished in the midst of budget airlines. Southwest Airlines and others, provided the same point A to point B travel – with less frills – at a much lower price. Pan Am’s weak story didn’t allow it to raise prices to combat rising fuel costs in the 70s. And geopolitical events such as the 1988 Lockerbie bombing, took a toll on Pan Am’s operations and reputation. Pan Am filed for bankruptcy and ceased operations in 1991.

Narrative drives price.

A true organic, compelling narrative is rare and valuable. It gives a business the freedom to set its prices without provoking second thoughts from its customers. Such enterprises often achieve exceptional, low-risk, high-yield returns with long duration.

As we navigate the treacherous waters of investment, let us distinguish the authentic from the contrived and remain vigilant against the siren song of enticing stories.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.