Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

Your initial due diligence might get you into a position, but it is your maintenance due diligence that will keep you invested and/or save you from big losses.

Your initial due diligence might get you into a position, but it is your maintenance due diligence that will keep you invested and/or save you from big losses. With small stocks your future returns are based upon your ability to course correct and adapt to new information. Reaction time is important.

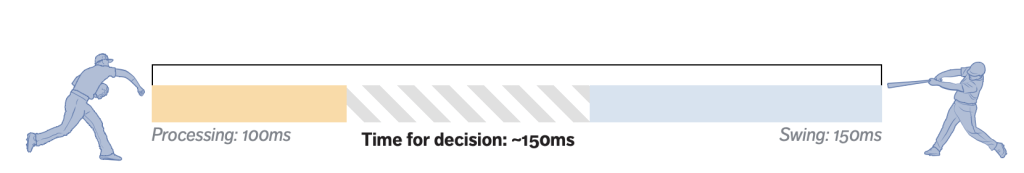

Sports Illustrated reported earlier this year that the number of major league pitches clocked at 100 mph or more tripled over the past three years (H/T Todd Wenning). A 100-mph fastball takes roughly 375-400 milliseconds to reach the plate. It’s about as much time as it takes to blink your eye. But a batter has far less time to identify the pitch and decide to swing. It takes roughly 75-100 milliseconds for the human brain to identify the ball. Then it takes a batter 100-150 milliseconds to swing. This means a batter has 150 milliseconds to decide to swing and how to swing at the ball. This leaves zero time for error. A batter has less than a half a second to react. Reaction time is important.

In men’s tennis, the typical speed of a first serve hovers around 115 mph. Given this speed, a player in a standard return position has roughly 0.47 seconds to respond and produce a return. The record for the fastest serve goes to Australian Sam Groth, clocking in at 163.7 mph, which requires an impressive reaction time of just 0.325 seconds for the returner. Here is Roger Federer effortlessly returning a 140 mph serve from a stunned Andy Roddick. Reaction time is important.

The length of a cricket pitch is 22 yards, equivalent to 20.12 meters. With the popping crease situated 1.22 meters away from the stumps, the actual distance between the bowler and batsman is about 17.68 meters. From this gap, several fast bowlers consistently deliver balls at speeds exceeding 150 Kmph (or 93 mph). When bowled at 150 Kmph, the batsman has a mere 0.42 seconds to make their move. Reaction time is important.

Snakes have intrigued scientists and enthusiasts for centuries, largely due to their unique mode of movement and lightning-fast reactions. A snake is built like a powerful rubber band. Snakes possess a linear body dominated by long, slender muscles, attached to a long vertebral column. This vertebral column comprises of up to 400 individual vertebrae, each attached to a pair of ribs. Such a design grants the snake an incredible degree of flexibility. When a snake wants to move or strike – this flexibility combined with 10,000 muscles produces acceleration of up to 20 g’s. Normal humans can withstand no more than 9 g’s, and even that for only a few seconds.

In 2016, David Penning and his colleagues at the University of Louisiana at Lafayette analysed the defensive strikes of snakes. The study found that the average strike lasts between 44 and 70 milliseconds, faster than the 300 milliseconds it takes you to blink your eye. This reaction time is crucial in surprising prey and also evading predators. Reaction time is important.

It only takes tens of thousands or hundreds of thousands of dollars to move a microcap stock. It takes millions of dollars to move a smallcap. It takes hundreds of millions to move a midcap and billions to move a largecap. Finding a great idea in microcap before others is important. Discovery is important because one or two investors can move the market.

Reaction time is even more important once you own a position. As microcap investors, we are investing in small emerging businesses and their business trajectories can change in an instant. Successful microcap investing isn’t about being right all the time; it’s more about the ability to identify when you are wrong quicker. Most of the stocks you own today you will end up selling. Once you embrace this fact – you can be free to look for disconfirming evidence. In illiquid stocks the ability to react quickly to positive or negative earnings, press releases, filings, and other data is crucial.

Here is an example – A 10Q (quarterly financial filing in US) is posted on SEC.gov. You are immediately notified. The stock market is open, and the company is slow to issue an earnings press release. While 90% of investors that own the stock are unaware, in 10 seconds you are able to discern this is a big miss. You are quickly able to sell all, or a portion of your position, and lock in gains/or small(er) loss. When everyone else wakes up to this reality the stock is down another 30%.

Here is another example – As a stock picker matures your edge goes from only being analytical to relational. The relationships you build with other investors, CEO’s, industry participants becomes your #1 asset. Your ability to get to the truth quicker becomes your advantage. Someone in your network attended an industry conference where a company you own also attended. Your friend knows you own the stock so he/she pokes around. Your friend speaks to a few sales reps of a competitor and they let you know the company you own started to drop the price of the product to keep market share. You know this is going to impact margins in future quarters. You quickly sell down and/or out of the position over the coming weeks.

Reaction time is important. You almost got bit.

The ultimate edge for conviction investors is our ongoing maintenance due diligence and knowing what we own at all times. It’s fun to talk about how maintenance due diligence gives you the conviction to hold, but most of the time it keeps you from getting bit.

===> Interact and learn with 250+ of the best microcap investors on the planet. [Join Us]

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 900+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit http://microcapclub.com and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.