Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

Dilution is the subtle erosion of ownership. This hidden, persistent addition of new supply of shares leaves shareholders with less and less of the company’s value. Dilution, like inflation, is a silent killer of returns.

In 2021, over a million people tuned in to watch an exhibition boxing match. Floyd Mayweather Jr., one of boxing's greatest fighters, faced off against the YouTuber-turned-boxer, Logan Paul.

The fight was forgetful, but what caught my attention was Logan Paul’s entrance. He walked into the ring wearing something odd around his neck.

Dangling from a chain was a Pokemon card set in what appeared to be a diamond encrusted frame. The card, a super rare Charizard card, is considered one of the crown jewels of Pokemon card collecting, with an estimated value of $1 million.

Logan Paul’s move signaled the peak of fervor in collecting Pokemon cards. Since the pandemic, both new and vintage Pokemon cards flew off store shelves. Pokemon cards experienced a substantial resurgence in popularity, likely fueled by aspirations of financial gain as prices for all cards were rising.

In response to surging demand, The Pokemon Company International, typically accustomed to producing 1-2 billion cards a year, made a move to inundate the market with more cards. Remarkably, in 2021 alone, their output swelled to over 9 billion cards. From the onset of the pandemic to 2022, the Pokemon franchise churned out more than 15 billion cards. That was equivalent to one-third of the total cards the company ever printed in its 26 years of existence!

The influx of supply diluted Pokemon card values. From the 2021 peak to trough, most Pokemon cards, except the rare ones, lost ~85% of their value.

However, The Pokemon Company International’s business continued to thrive. According to the Japanese government’s official gazette, the company posted the following results:

2020 - $1.1 billion sales, $170 million USD profit (21% growth over prior year)

2021 - $1.6 billion sales, $320 million USD profit (115% growth over prior year)

2022 - $1.67 billion sales, $480 million USD profit (20% growth over prior year)

What was good for The Pokemon Company International, was a disaster for the secondary market of card owners.

Dilution kills, if you are on the wrong side of the card.

A microcap investor’s biggest risk is dilution.

Dilution is the subtle erosion of ownership. This hidden, persistent addition of new supply of shares leaves shareholders with less and less of the company’s value. Dilution, like inflation, is a silent killer of returns.

Some companies have a valid reason for raising capital and diluting shareholders: to secure capital for growth.

For example, Amazon has diluted shareholders 96% - split adjusted - since its IPO in 1997. In other words, if you bought at the IPO and continued to hold it today, you would own 96% less of Amazon than you originally did.

Did dilution matter? Of course not. Amazon shares are up 2,293 times since the IPO. Capital raised was reinvested back into the business, and those dollars built an asset that prints astronomically more dollars than it cost.

In other words, it was more valuable to own a smaller, and smaller piece of this as it got built:

As opposed to owning a large piece of this:

Nearly all microcap companies aren’t Amazon, however. Like The Pokemon Company International, many microcap companies are in the business of perpetually supplying the market with stock.

Many microcaps fail to graduate from stories to real businesses. Instead, they act as conduits channeling money to management and service providers. Here is the dilutive cycle:

Create a story -> investment banks raise money -> investment banks, attorneys, consultants, investor relations, and management take the money back out -> Rinse and repeat as long as possible.

On MicroCapClub, ~1,000 companies have been profiled by our members since 2011. The losers, those whose stock values have declined 50-99% since being posted at least 5 years ago (100 companies) diluted their shareholders on average 61%.

When we look at the winners, those companies whose stock values have increased at rates higher than the market and were profiled at least 5 years ago (76 “multibaggers”). These companies diluted their shareholders on average 22%, or 64% less than the losers.

Two things come to mind: 1) an increase in dilution hurts returns and 2) zero dilution - or even share buy backs - don’t automatically mean you won’t lose money. A turd is a turd, regardless how much you dilute it.

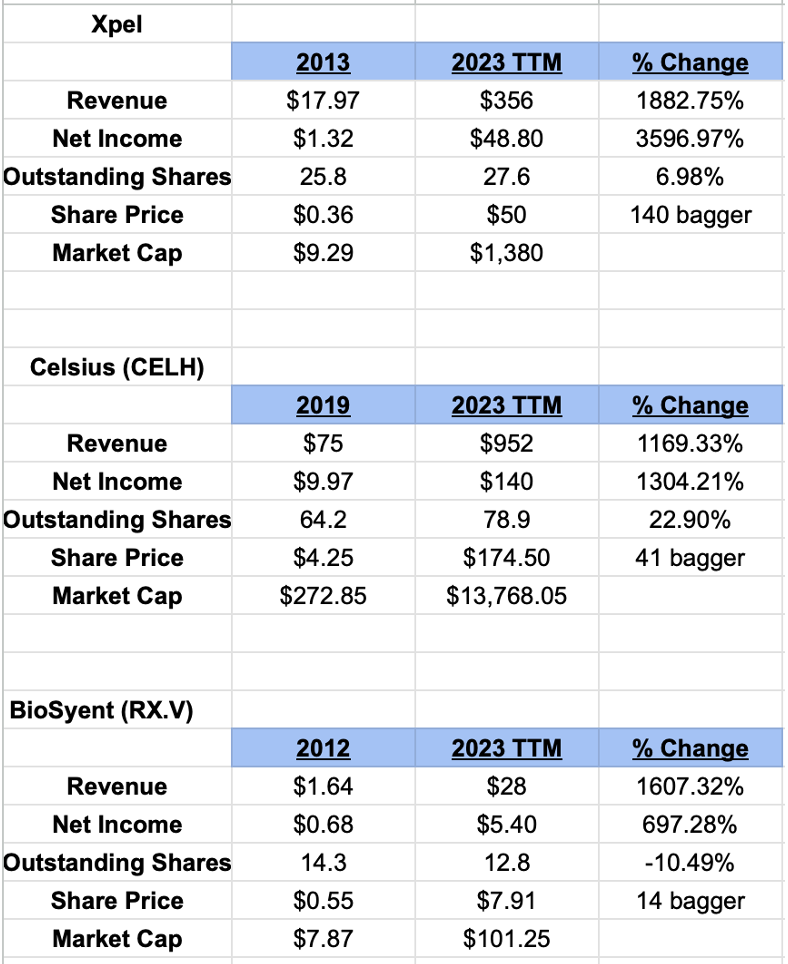

It’s the lack of dilution and the long-term revenue and earnings growth that drove the greatest returners phenomenal gains. See some of the top returners below.

Dilution waters down greatness.

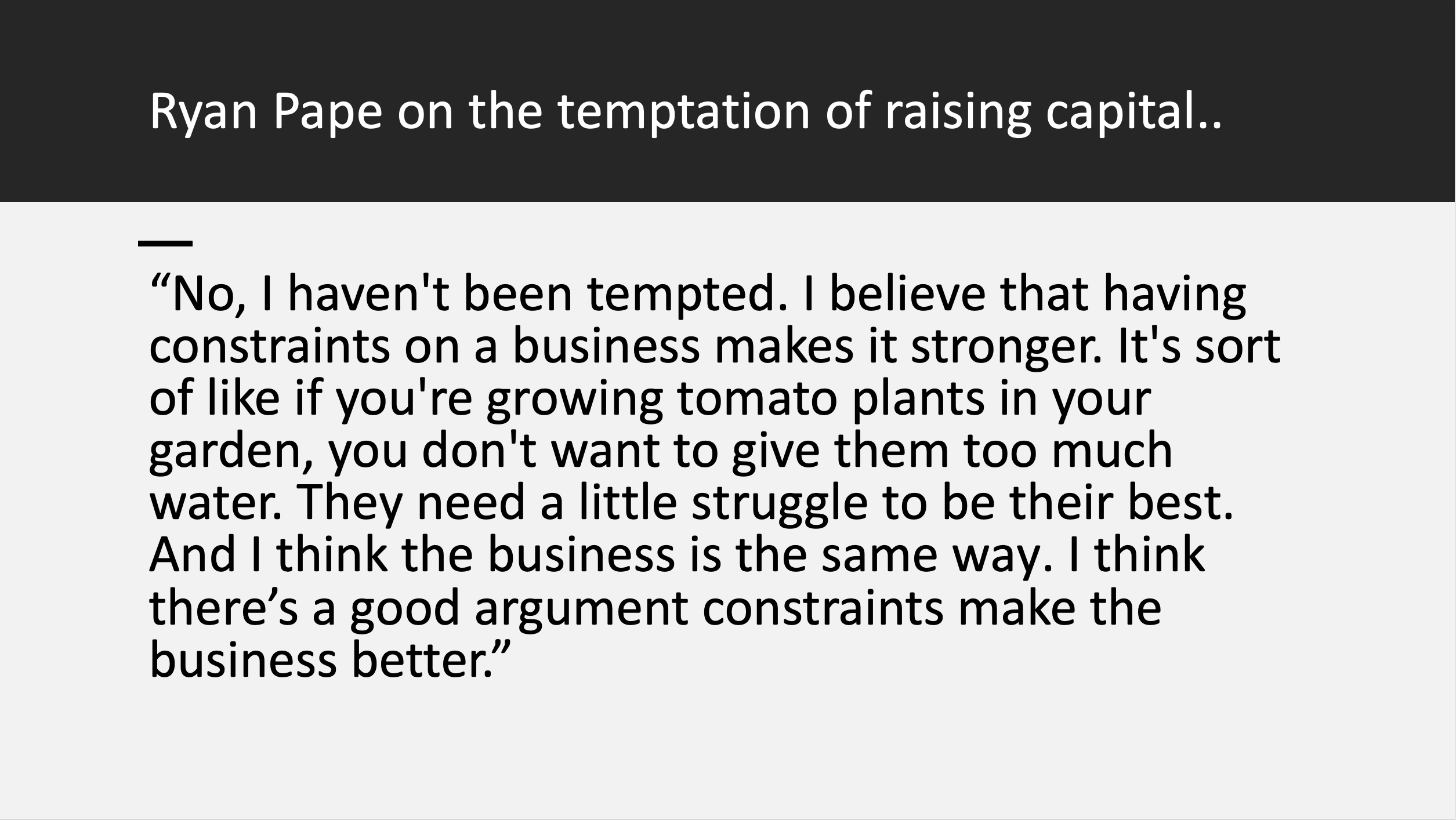

Ryan Pape became CEO of XPEL in February of 2009. Since then, the stock has risen 100,000%. He’s probably one of a dozen or so CEO’s ever that can say they lead a 1000+ bagger the entire journey. At our MicroCap Leadership Summit, Ryan spoke about the importance of skin in the game, constraints and keeping dilution minimal [WATCH FULL INTERVIEW].

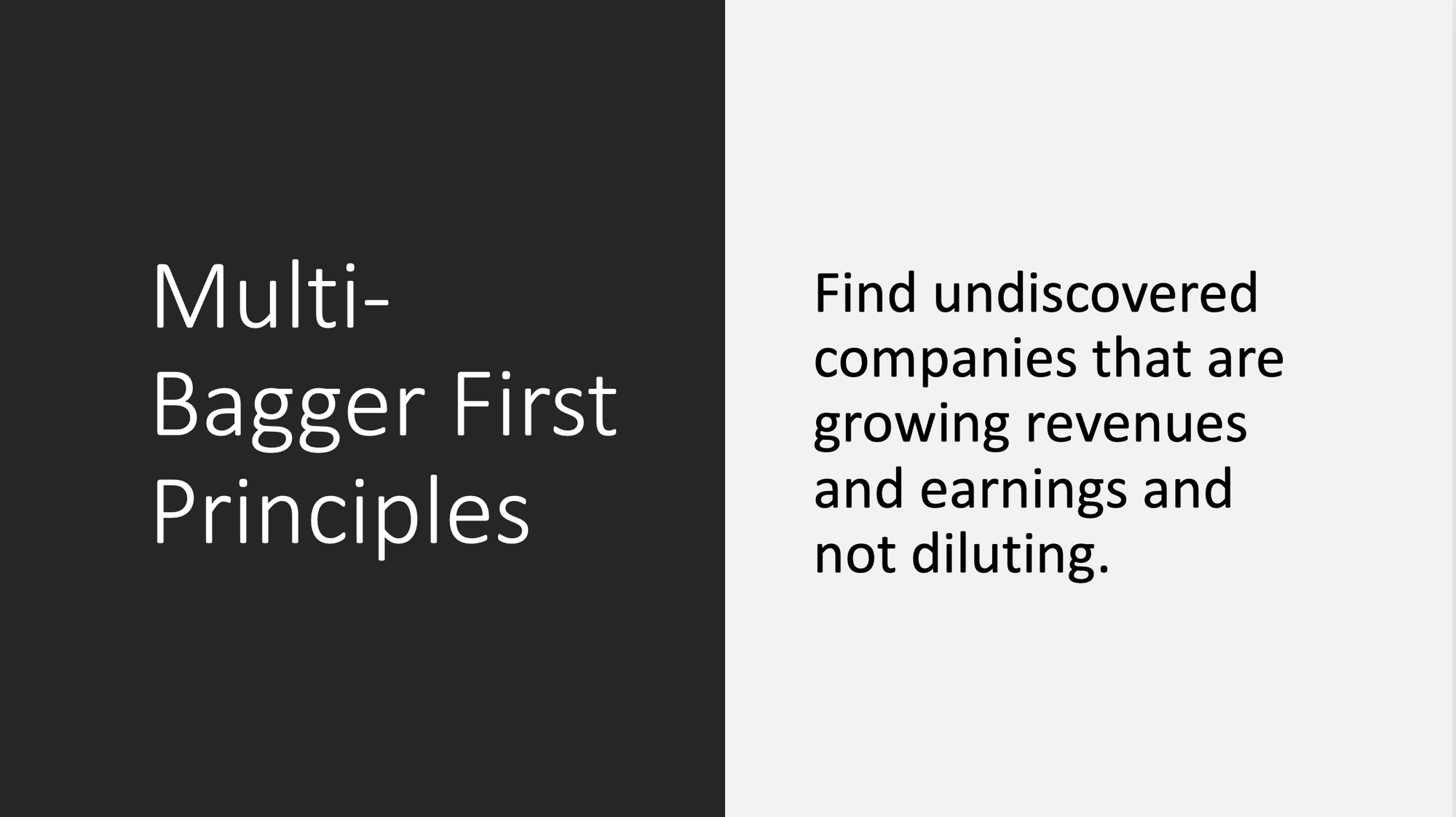

In October, Ian Cassel, gave a presentation titled: Multi-Bagger First Principles. I would encourage you to watch it twice. We all want to find great companies early. We all want to find multi-baggers. At the end of the presentation, Ian boils it down to one sentence below.

“Tattoo this sentence on your spouse’s forehead so you don’t forget it” Ian says. I’d like to stay married so I won’t, but the point is valid. The multi-bagger formula is this simple and this hard.

Invest in companies that are not only growing revenue and profits at impressive rates but are also thoughtful about issuing additional shares. By doing so you have house odds of getting a multi-bagger. As more share issuance is added into the equation, the chances of multi-bagger success drop with each dilutive event.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.